for Administrators

Open Accounts Remotely,

Manage Clients,

Profit from Activity

Remote Onboarding

Open accounts for your company and clients without in-person meetings

Real-Time Analytics

Monitor client activity and performance with detailed insights

Earn Rewards

Increase your revenue as you build a strong base of engaged client

Client Autonomy

Give clients full control over their accounts while you track their progress

EASY OPEN

Remote Onboarding

Administrators can open accounts for clients and their own company remotely through the platform, eliminating the need for in-person meetings. The onboarding process is simplified and accelerated, minimizing delays and paperwork.

What you get

The ability to quickly and easily open accounts for your company and clients, while speeding up the client acquisition process.

Benefit

Save time by removing the need for physical meetings and complex forms. Simplify the onboarding process, reduce administrative friction, and accelerate growth.

EASY ANALYSE

Real-Time Analytics

Gain access to up-to-the-minute data on client activity and account performance. Monitor transactions, usage patterns, and engagement metrics, all in one platform.

What you get

Full access to live analytics showing how your clients are interacting with their accounts, helping you identify opportunities for improvement.

Benefit

Leverage real-time data to make proactive decisions. Improve client satisfaction by tailoring services based on their activity, and optimize your interactions to foster stronger client relationships.

PROFIT-SHARING OPPORTUNITIES

Earn rewards

on client activity

We offer profit-sharing opportunities where you, as an administrator, earn a percentage of your clients' activity. The more your clients engage with the platform, the more you earn.

What you get

A % return on the activity of each client you onboard. This is a unique opportunity to turn your client management into a profitable venture.

Benefit

Increase your revenue as you build a strong base of engaged clients, turning client success into your own financial success.

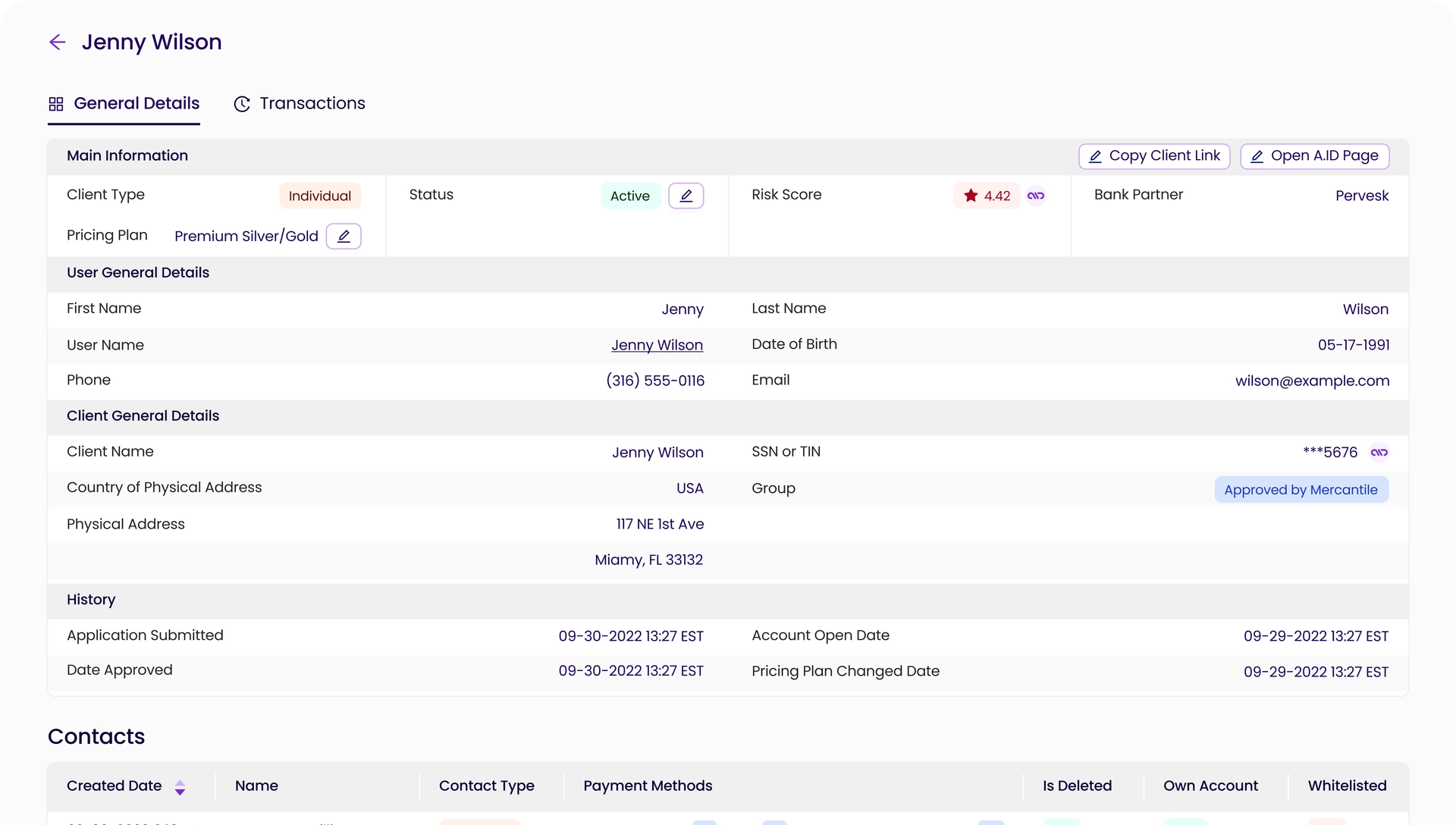

EASY MANAGE

Client Autonomy

Empower your clients with full control over their accounts. They can manage their transactions, view their balance, and perform actions independently, while administrators can monitor their progress.

What you get

Clients have 24/7 access to manage their accounts directly, with you maintaining oversight.

Benefit

By giving clients control, you increase engagement and satisfaction. It also reduces administrative tasks, as clients can independently manage their accounts, reducing the need for constant support.

EASY TRACK

User

Management

Full visibility and control over your user base.

User Overview

View and manage all users from a single, intuitive dashboard for complete control over your user base.

User Role Management

Assign and adjust user roles and permissions with just a few clicks, ensuring the right access for the right people.

Audit Trail

Keep a detailed, timestamped log of all user actions for full transparency. Easily review changes and actions taken across the platform

The Digital Bank for Global Businesses

Arival Bank provides seamless remote account opening and real-time analytics, empowering businesses to manage both client and company accounts with ease.

With secure, flexible tools and 24/7 support, we offer tailored banking solutions for businesses of all sizes, ensuring efficiency and growth on a global scale.

Already with Arival?

Let’s Talk Partnership Opportunities!